dependent care fsa rules 2021

The full 15500 reimbursed by the dependent care FSA in the 2021 plan year is excluded from the employees income. If you are interested in making a change to your DCFSA election.

2021 Changes To Dependent Care Fsas And What To Know

Dependent Care Flexible Spending Account Basics.

. The american rescue plan act of 2021 gives employers the option to. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. The limit is expected to go back to 5000.

For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. The carryover option expires on December 31 2021. Included in the changes was the one-time change to the contribution limit for dependent care FSAs thats to say the contribution limit is not permanently changed but changed for 2021 only.

Because of the American Rescue Plan signed into law in March 2021 the contribution limit has been raised to 5500 for married couples filing jointly or 2750 for an individual or married person filing separately. Unused health and dependent care FSA funds are forfeited at the end of the plan year known as the. While it is optional we have decided to adopt this change.

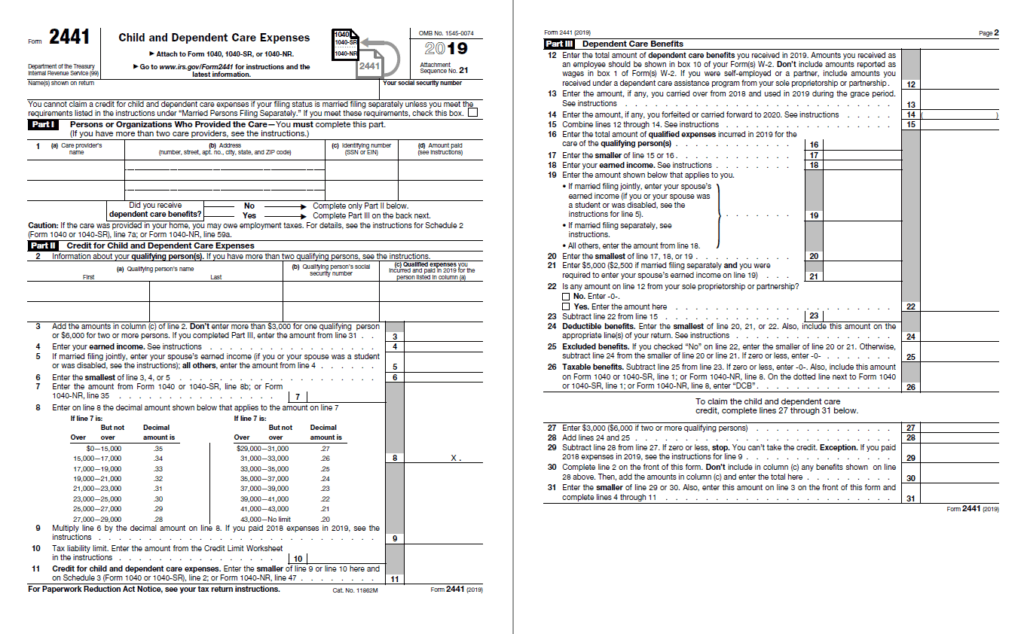

Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit. Dependent Care FSA FAQs Alicia Main 2021-08-23T130406-0400. That means for a married couple each parent can contribute 2500 to their own Dependent Care FSA for a total of 5000.

As more companies adopt the. The new contribution limit is 10500 for 2021 for single taxpayers and married filing jointly a limit that was previously set at 5000 per year. Parents and caregivers can use funds in this type of account to pay child care or elder daycare bills.

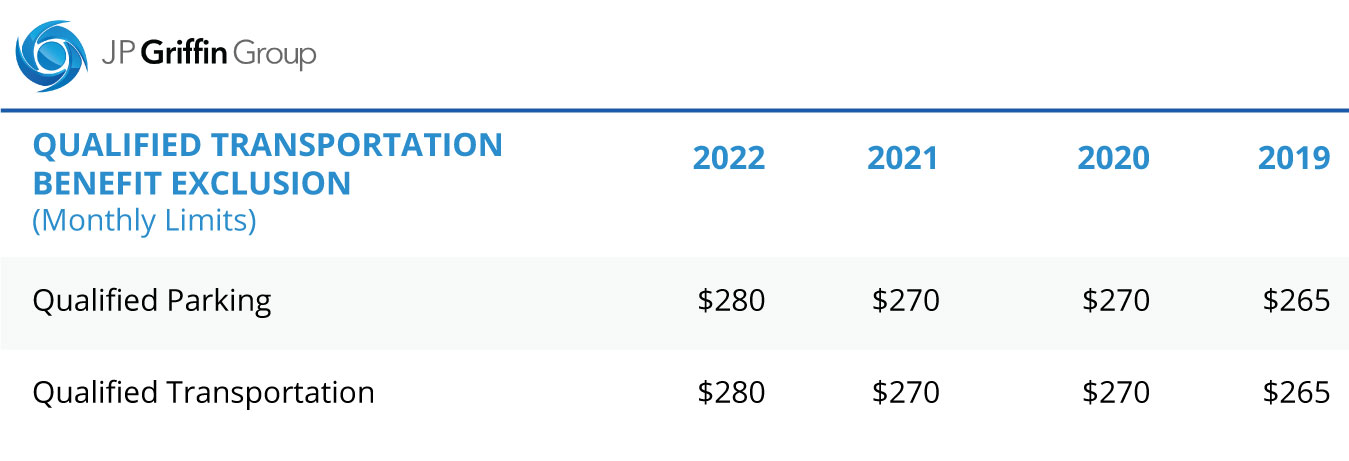

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately. If you want to make a change to your dependent care FSA elections please contact the OHR Benefits Department by submitting an inquiry online or by calling 833-852-2210.

Relaxed Rules for Health and Dependent Care Flexible Spending Arrangements Become Law Providing New Options for Employers The Consolidated Appropriations Act 2021 was signed into law Sunday December 27 and includes nearly 1 trillion in COVID-related relief including welcome relief for Flexible Spending Arrangements requested by. A family using an FSA to cover qualifying expenses can save thousands of dollars every year with little downside. What is a dependent care FSA.

Single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing. Changes must be submitted no later than May 31 2021 to be accepted and processed for this plan year FY 21. For 2021 the ARP increased the maximum amount that can be excluded from an employees income through a dependent care assistance program to 10500 5250 if married filing separately.

It pays to learn the Dependent Care Flexible Spending Account FSA rules if you have a spouse not working or your child participates in programs that test the boundaries of IRS eligibility. February 11 2021 2021-R-0054 Issue Explain federal rules that apply to health and dependent care flexible spending accounts also called arrangements including the use it or lose it rule and summarize any relief from the rules. If your employer had an FSA grace period it could be extended beyond the 25 months to the end of the plan year ie December 2022.

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycareIts a smart simple way to save money while taking care of your loved ones so that you can continue to work. In order to qualify for the mid-year change the normal rules must apply. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Dependent Care Tax Credit. PA Group administers our FSA plan including reimbursements.

No election changes will be accepted after May 31 2021. For 2022 the FSA carryover has been raised to 570 Normally a dependent care FSA also known as a Dependent. Dependent eligibility situations where a dependent satisfies or ceases to satisfy the rules for eligible dependents due to the attainment of age.

Per irs rules the total that each family can elect for a dependent care fsa dcfsa must not exceed 5000 per household 2500 each if married and filing separately. Contributing to this benefit reduces taxable income and spreads the benefits of pre-tax dollars throughout the year helping you save 30 percent or more on your. Posted 2021-07-12 July 12 2021.

The IRS has special rules for who gets to use a dependent care FSA to pay for care-related expenses. September 16 2021 by Kevin Haney. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

This amount is set by statute and not. 3 Any unused amounts from your 2020 Child Care Dependent Care FSA will automatically be carried over into 2021 and may be used to pay or reimburse eligible dependent care expenses that are incurred in 2021. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples.

The Savings Power of This FSA. Day camp expenses are eligible for reimbursement from a Dependent Care FSA as long as they provide custodial care for children under the age of 13 so the parents. For the 2021 tax year there is a temporary increase to the Dependent Care FSA limit.

On march 11 2021 the american rescue plan act of 2021 arpa was signed into law by president biden. Earlier in 2020 the IRS updated the rules to increase the maximum health FSA carryover from 500 to 550. If the company had the 550 carryover allowance for health.

ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. By Hayden Goethe A dependent care flexible spending account lets participants set aside pre-tax dollars to help pay for dependent care. Dependent Care FSA.

If you have a dependent care FSA pay special attention to the limit change. A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only.

Unused amounts from 2020 are added to the maximum amount of dependent care benefits that are allowed for 2021. Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then again from 2021 to 2022.

You Can Get Up To 8 000 In Child And Dependent Care Credit For 2021 Forbes Advisor

What Is Fsa Dependent Care Workest

Child And Dependent Care Expenses Credit Youtube

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

Dependent Care Benefits Overview Criteria Types

Why You Should Consider A Dependent Care Fsa

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Fsa Flexible Spending Account Ppt Download

How A Dependent Care Fsa Can Enhance Your Benefits Package

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What To Know About Dependent Care Fsas And Saving Money On Childcare Real Simple

What Is A Dependent Care Fsa Wex Inc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

How The American Rescue Plan Act Of 2021 Impacts Dependent Care Assistance Programs Word On Benefits

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Flexible Spending Accounts Flex Made Easy